Missed the Tax Deadline? Here are Payment and Relief Tips

For taxpayers who missed the tax filing deadline, they may be subject to interest and penalties if they owe.

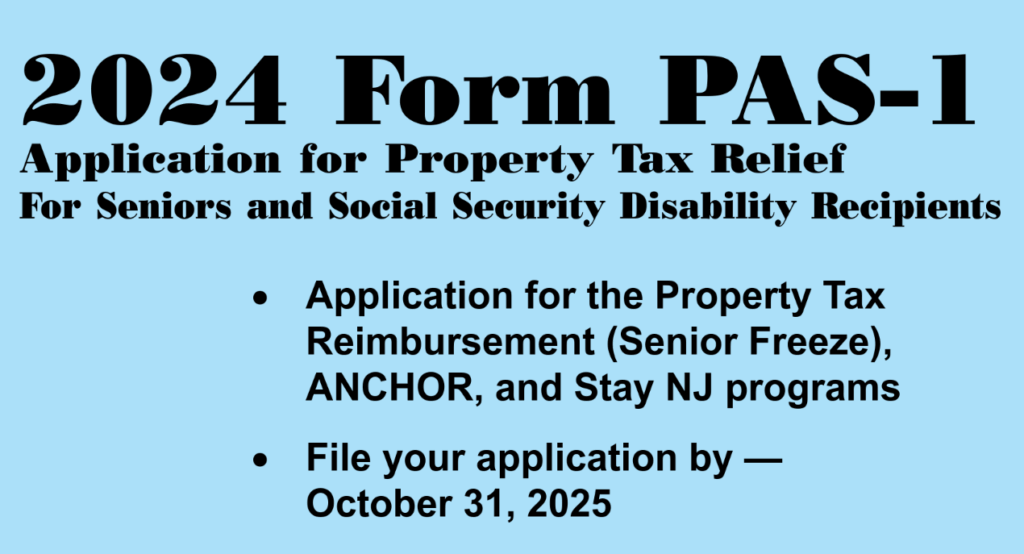

Frequently Asked Questions for the PAS-1 Form

With the new PAS-1 process, it is common to have questions about what has changed and when applicants should expect to receive payments.

2025’s Dirty Dozen Tax Scams

Although this year’s tax season is over, it is important to stay informed to avoid falling victim to these common tax scams.

Is the BOI Already Dead?

Is the BOI already dead? A federal judge has ruled that the Corporate Transparency Act (CTA) and its beneficial ownership information (BOI) reporting requirement are unconstitutional, but only for the National Small Business Association (NSBA) and its 60,000+ members as of March 1, 2024. The ruling, however, has the potential to have nationwide consequences as […]

How to File an Extension for Your Tax Return

Are you ready for Tax Day? Need more time to prepare your federal tax return? Please be aware that an extension of time to file your return does not grant you any extension of time to pay your taxes. You should estimate and pay any owed taxes by your regular deadline to help avoid possible penalties. You must file […]

Beware of Scams This Tax Season

The IRS warns taxpayers to be wary of scam mailing that claims they are owed an “unclaimed refund”. These scams then request sensitive information from taxpayers including but not limited to detailed pictures of drivers’ licenses to commit identity theft and fraud. These scams can be recognized by awkward wording, requests for bank routing information, […]

IRS Improvements to Assist Taxpayers

The IRS has released some new improvements to assist taxpayers this filing season. This includes expanding in person services and a reduction in wait times on the IRS toll-free call line with a new customer callback feature. There have also been improvements to online resources such as the “Where’s My Refund?” tool and the paperless […]

Tax Treatment of Interest on Student Loans

Student loans are a burden on many Americans, but thankfully there is a way to retrieve a portion of the money spent on the interest payments. For the interest on qualified education loans, the maximum deduction allowed for the taxable year is $2,500. Single Filers Full Deduction < $70,000 No Deduction > $85,000 Joint Filers […]

Changes to 2023 Tax Deductions

The following annual adjustments are applicable to the 2023 tax year. You can read more on irs.gov.https://www.irs.gov/newsroom/irs-provides-tax-inflation-adjustments-for-tax-year-2023

2026 Proposed Senior Property Tax Changes

StayNJ is a recently finalized program aimed at assisting homeowners and renters 65 years of age and older in New Jersey. The fine details on filings & procedures are currently being ironed out. Click the link below for more details.https://www.nytimes.com/2023/06/21/nyregion/property-tax-cut-new-jersey.html